Summary

Summary Journal entries Accounting (bookkeeping)

- Course

- Institution

- Book

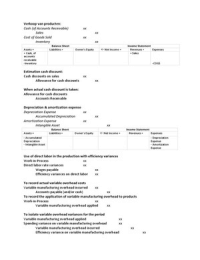

Journal entries for the accounting profession. 1/4 of the examination thus consists of the preparation of journal entries super convenient to know these by heart!

[Show more]