Value

Management

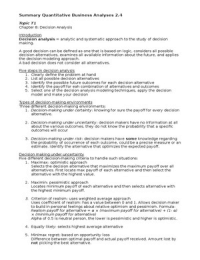

Summary of the Lectures

Given in: 2021/2022 | Summary by LouisT

,Contents

Chapter 1. The Introduction to the Course ............................................................................................ 4

1.1 Capacity Costing ...................................................................................................................... 4

1.1.1 Computation of Capacity Costing ................................................................................... 4

1.2 Paper Buchheit (2003): Reporting the cost of capacity ......................................................... 6

1.3 Paper Anderson et al. (2003): Are SG&A costs ‘sticky? ......................................................... 8

1.4 Closing Paragraph ................................................................................................................. 10

Chapter 2. Customer Profitability ........................................................................................................ 11

2.1 Strategic Management Accounting ...................................................................................... 11

2.2 Value Chain Analysis ............................................................................................................. 11

2.2.1 Total Cost of Ownership ............................................................................................... 11

2.3 Customer Profitability .......................................................................................................... 13

2.4 Paper Paper Holm, M., & Ax, C. (2020) ................................................................................ 13

2.5 Customer Lifetime value and Perceived Customer Value ................................................... 15

2.5.1 Customer Lifetime Value .............................................................................................. 15

2.6 Paper Terpstra, M. & Verbeeten, F.H................................................................................... 16

2.7 Perceived Customer Value ................................................................................................... 17

2.8 Summary ............................................................................................................................... 18

Chapter 3. Long-Term Decision Making ............................................................................................... 19

3.1 Total Life Cycle Costing ......................................................................................................... 19

3.1.1 Life Cycle Costing: Example .......................................................................................... 19

3.1.2 Life Cycle Costing: In Practice ....................................................................................... 20

3.2 CSR and full costing............................................................................................................... 20

3.2.1 Full cost accounting: example ...................................................................................... 22

3.3 Paper Henri et al. (2016): Two forms of Strategic Cost Management ................................ 23

3.4 Flexibility: Real options and Game Theory .......................................................................... 25

3.4.1 Game Theory ................................................................................................................. 25

3.4.2 Managers incorporation of ROR in investment decisions ........................................... 28

Chapter 4. Innovation ........................................................................................................................... 31

4.1 What is innovation? .............................................................................................................. 31

4.2 Innovation Management ...................................................................................................... 31

4.2.1 Open innovation models .................................................................................................. 33

4.3 Management accounting in an innovation context ............................................................ 33

4.3.1 Balanced Role for Management Accounting ................................................................... 33

4.4 Metrics for innovation .......................................................................................................... 34

4.4.1 Input Measures ................................................................................................................. 35

A summary by LouisT on Stuvia.nl | Thank you for your purchase! | Version 2.0 (Final)

, 4.4.2 Process Measures ............................................................................................................. 35

4.4.3 Output Measures .............................................................................................................. 36

4.4.4 Outcome Measures........................................................................................................... 36

4.5 Target Costing and Beyond................................................................................................... 37

4.4.1 Challenges of target costing ......................................................................................... 38

4.4.2 Paper: Davila & Wouters (2004): Limitations of Target costing .................................. 39

Chapter 5. Decision facilitating and top level vs workfloor level ....................................................... 40

5.1 Decision facilitating vs Decision influencing ........................................................................ 40

5.2 Performance Measurements ................................................................................................ 40

5.2.1 Financial Measures ....................................................................................................... 40

5.2.2 Non-financial measures ................................................................................................ 40

5.2.3 Quality criteria for evaluating performance measures ............................................... 40

5.3 Testing business models ....................................................................................................... 41

5.3.1 Business Model ............................................................................................................. 41

5.4 Paper: Campbell et al. (2015) ............................................................................................... 43

5.4.1 Data method ................................................................................................................. 44

5.4.2 Results ........................................................................................................................... 44

5.5 Top Level vs Workfloor Level perspective on (N)FPM ......................................................... 46

5.5.1 Combination of top-level and work floor perspective ................................................ 46

5.5.2 Control Frameworks ..................................................................................................... 47

5.5.3 Coercive vs enabling systems: repair ........................................................................... 47

5.6 Paper: Wouters, M., & Wilderom, C (2008) ......................................................................... 47

5.6.2 PMS ............................................................................................................................... 48

5.6.3 Propositions .................................................................................................................. 48

5.6.3 Data Methods ............................................................................................................... 48

5.6.4 Results ........................................................................................................................... 48

5.6.4 Conclusion ..................................................................................................................... 49

5.7 Summary ............................................................................................................................... 49

Chapter 6. Controllers........................................................................................................................... 50

6.1 Roles of Controllers .............................................................................................................. 50

6.1.1 Impact of Technology on Controllers ........................................................................... 50

6.2 Centralization vs Decentralization ....................................................................................... 50

6.2.1 Paper: Labro, Lang, and Omartian (2021): Predictive Analytics and Organizational

Architecture .................................................................................................................................. 51

6.2.2 Research Questions ...................................................................................................... 52

6.2.3 Results ........................................................................................................................... 53

A summary by LouisT on Stuvia.nl | Thank you for your purchase! | Version 2.0 (Final)

, 6.3 Technology, Outsourcing and SSC ........................................................................................ 57

6.3.1 Impact of Technology ................................................................................................... 57

6.3.2 Outsourcing and SSC ..................................................................................................... 59

6.3.3 Paper: Goretzi & Messnet (2019) - Management accounting identity work.............. 60

6.4 Management Accounting for Projects ................................................................................. 61

Chapter 7. Summary of the course ...................................................................................................... 63

A summary by LouisT on Stuvia.nl | Thank you for your purchase! | Version 2.0 (Final)

,Chapter 1. The Introduction to the Course

Thank you for your purchase. In this chapter, you will receive an introduction to the course. Every

chapter, if necessary, will include pre-knowledge. Pre-knowledge means we assume you already

know this and will not be discussed in further detail.

Pre-Knowledge: Cost/Volume/Profit Analysis

1.1 Capacity Costing

Cost management is important. This is because you want to know how your costs are allocated and

how it behaves. However, cost management effectiveness is a lagging cost management practice,

which means it requires insights into cost allocation and cost behavior.

There are two types of costs, which are:

• Committed Costs: These costs are associated with committed resources, which are not easily

adjustable. This could be personnel costs (Tenured) or rent

• Flexible Costs: These costs are easier to adjust and are associated with flexible resources.

This could be materials because you can order less if there is less demand.

Organizations can make trade-offs over time. These trade-offs could be that you can choose between

tenured or flexible labor. In the end, all costs are flexible in the long run.

Capacity vs Activity Level

The total cost function provides a total estimated cost for a company, which depends on two things,

namely upon the choice of capacity and upon activity level. Most companies have high levels of

committed costs. This means margin improves when revenues go up, while margin decreases when

revenues go down.

We also look at the differences when looking at the cost allocation, which are:

• Indirect Costs (Common Costs): These costs are independent of the level of capacity. Great

examples are: “Human Resource”, “Headquarters” and “Manufacturing Facility”.

Importantly, these costs are generally committed costs but, for example, the manufacturing

facility has a certain limit. When this is reached, you need another manufacturing facility,

which means there is some flexibility.

• Direct Costs: These are directly attributable to a product, such as materials.

1.1.1 Computation of Capacity Costing

We look at Resources supplied = resources used + unused capacity.

The costs of unused capacity depend:

• upon the choice of capacity (Previous investments, safety margins).

• Depends on average use (normal utilization).

• Depends upon customer demands.

• Depends on (developments in) demand patterns over time (actual/budgeted utilization).

Example: Dutch National Railway (NS)

The NS looks at the demand, averages, and required capacity for railroad cars. A railroad car has a

cost 50,000 euro. They have 5 idle cars due to maintenance, breakdowns, etc.

Sun Mon Tue Wednesday Thursday Friday Saturday Average Required

10 50 50 45 50 55 20 40 60

A summary by LouisT on Stuvia.nl | Thank you for your purchase!

4

, 60 cars are therefore required to handle the peak

capacity. To allocate these costs, we have to look at

the recourses supplied, unused capacity, and

resources used (average).

Capacity Levels

We distinguish five capacity levels. These are:

1. Theoretical Capacity: Optimal amount of work that an asset can complete during full

operation.

2. Practical Capacity: Level of output generally attainable by an asset (includes non-productive

time such as maintenance of breakdowns)

3. Normal Capacity: Average, expected utilized capacity of machine over a defined period.

4. Budgeted Capacity: Planned utilization of assets for the coming year.

5. Actual Capacity: Capacity used for period production (utilized machine hours)

We want to determine this because you want to represent the profitability the right way. The

product is integrated into the cost price of the product, while we also have period costs in the

income statement. When you only show the product costs, which means you apply the theoretical

capacity, you might give the wrong impression of the product.

Example: Dutch National Railway (NS) (Continuation)

Here you have an example of how it matters when choosing a different capacity level to determine

the costs. When you use normal and actual capacity, you show the product is profitable.

A summary by LouisT on Stuvia.nl | Thank you for your purchase! | Version 2.0 (Final)