Summary

Summary intermediate financial accounting

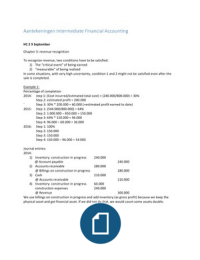

- Course

- Institution

This document contains a comprehensive summary of the course Intermediate Financial Accounting Tilburg University. The theory is being treated, but also there are elaborations of the examples in this document.

[Show more]