In this report I will be considering each ratio and would make an evaluation of the strength

and weakness of Mainwaring Engineering bearing in mind the statistics of last year and the

industry average. I will also provide the limitations of the ratio analysis and finalise my work

with a conclusion of my report.

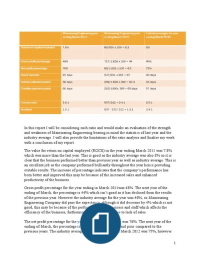

The value for return on capital employed (ROCE) in the year ending March 2011 was 7.8%

which was more than the last year. This is good as the industry average was also 8% so it is

clear that the business performed better than previous year as well as industry average. This is

an excellent job as the company performed brilliantly throughout the year hence providing

evitable results. The increase of percentage indicates that the company’s performance has

been better and improved this may be because of the increased sales and enhanced

productivity of the business.

Gross profit percentage for the year ending in March 2011was 48%. The next year of the

ending of March, the percentage is 44% which isn’t good as it has declined from the results

of the previous year. However the industry average for the year was 40%, so Mainwaring

Engineering Company did pass the expectancy, although it did decrease by 4% which is not

good, this may be because of the performance of the business and staff which affects the

efficiency of the business, furthermore this may also be due to lack of sales.

The net profit percentage for the year ending in March 2011 was 76%. The next year of the

ending of March, the percentage is 4.2% which is very bad and poor compared to the

previous years. The industry average for the year ending of March 2012 was 75%, however

1

, the company performed poorly and made a staggering 4.2% which is horrific as the

percentage declined rapidly. This may have been caused due to poor business performance, as

the business lacked customer service, decline in sales and some other factors why may have

disrupted the growth of the business and assisted the factors to such an extent that the

business performance was the worst it possibly ever could be.

For stock turnover, during the year ending March 2011 the stock turnover days is 92. The

next year of the ending of March, the stock turnover day is 95 which is better compared to the

previous year, and it has increased by 3 days which is important. The industry averaged the

year at 90 days, but it has surpassed that prediction and it came up with 95 days. This type of

results indicates that the performance of the business is good because if the stock turnover is

high then it means that the sale of stock is healthy, which is a very beneficial to the business.

The debtor collection period, during the year ending March 2011 the debtor collection period

is 58 days. The next year of the ending of March, the debtor collection period is 60.3 days

which comparatively poor as it has increased by 2 days. The industry average for the year is

55 days; however the business is going beyond that expectation which is not good. Hence it

means that the business is taking longer time to claim their money back from the people who

owe them money, this can be very harmful as some persons can take it easy and might even

take longer time to return a bigger amount in the future.

The creditor payment period, during the year ending in March 2011is 60 days. The next year

of the ending of March, the credit payment period is 262.3 days which is a very poor

performance because it has increased by 200 days over the one year period. The industry

average for the year was 57 days but the business is going beyond that forecast and that's not

good as the business have to pay more to its creditors. This means that the business owes

money to people or suppliers and 262.3 days is a lot of money that they need to pay off. This

will affect the business dramatically as they won’t be able to pay off as it would increase the

burden on the business. Hence if the suppliers are not paid in time or the time agreed then the

suppliers won’t supply the raw materials to the business. Then the business might have to

change their suppliers and maybe the new suppliers will provide the same products and

materials at an expensive rate that the business have to control, which will eventually

increase the price for their products and services.

Limitations of Ratio Analysis

Ratio analysis can be used to compare information taken from the financial statements to gain

a general understanding of the results, financial position, and cash flows of a business. This

analysis is a useful tool, especially for an outsider such as a credit analyst, lender, or stock

analyst. These people need to create a picture of the financial results and position of a

business just from its financial statements. Despite the usefulness there are some limitations

of ratio analysis as well:

Inflation

2

and weakness of Mainwaring Engineering bearing in mind the statistics of last year and the

industry average. I will also provide the limitations of the ratio analysis and finalise my work

with a conclusion of my report.

The value for return on capital employed (ROCE) in the year ending March 2011 was 7.8%

which was more than the last year. This is good as the industry average was also 8% so it is

clear that the business performed better than previous year as well as industry average. This is

an excellent job as the company performed brilliantly throughout the year hence providing

evitable results. The increase of percentage indicates that the company’s performance has

been better and improved this may be because of the increased sales and enhanced

productivity of the business.

Gross profit percentage for the year ending in March 2011was 48%. The next year of the

ending of March, the percentage is 44% which isn’t good as it has declined from the results

of the previous year. However the industry average for the year was 40%, so Mainwaring

Engineering Company did pass the expectancy, although it did decrease by 4% which is not

good, this may be because of the performance of the business and staff which affects the

efficiency of the business, furthermore this may also be due to lack of sales.

The net profit percentage for the year ending in March 2011 was 76%. The next year of the

ending of March, the percentage is 4.2% which is very bad and poor compared to the

previous years. The industry average for the year ending of March 2012 was 75%, however

1

, the company performed poorly and made a staggering 4.2% which is horrific as the

percentage declined rapidly. This may have been caused due to poor business performance, as

the business lacked customer service, decline in sales and some other factors why may have

disrupted the growth of the business and assisted the factors to such an extent that the

business performance was the worst it possibly ever could be.

For stock turnover, during the year ending March 2011 the stock turnover days is 92. The

next year of the ending of March, the stock turnover day is 95 which is better compared to the

previous year, and it has increased by 3 days which is important. The industry averaged the

year at 90 days, but it has surpassed that prediction and it came up with 95 days. This type of

results indicates that the performance of the business is good because if the stock turnover is

high then it means that the sale of stock is healthy, which is a very beneficial to the business.

The debtor collection period, during the year ending March 2011 the debtor collection period

is 58 days. The next year of the ending of March, the debtor collection period is 60.3 days

which comparatively poor as it has increased by 2 days. The industry average for the year is

55 days; however the business is going beyond that expectation which is not good. Hence it

means that the business is taking longer time to claim their money back from the people who

owe them money, this can be very harmful as some persons can take it easy and might even

take longer time to return a bigger amount in the future.

The creditor payment period, during the year ending in March 2011is 60 days. The next year

of the ending of March, the credit payment period is 262.3 days which is a very poor

performance because it has increased by 200 days over the one year period. The industry

average for the year was 57 days but the business is going beyond that forecast and that's not

good as the business have to pay more to its creditors. This means that the business owes

money to people or suppliers and 262.3 days is a lot of money that they need to pay off. This

will affect the business dramatically as they won’t be able to pay off as it would increase the

burden on the business. Hence if the suppliers are not paid in time or the time agreed then the

suppliers won’t supply the raw materials to the business. Then the business might have to

change their suppliers and maybe the new suppliers will provide the same products and

materials at an expensive rate that the business have to control, which will eventually

increase the price for their products and services.

Limitations of Ratio Analysis

Ratio analysis can be used to compare information taken from the financial statements to gain

a general understanding of the results, financial position, and cash flows of a business. This

analysis is a useful tool, especially for an outsider such as a credit analyst, lender, or stock

analyst. These people need to create a picture of the financial results and position of a

business just from its financial statements. Despite the usefulness there are some limitations

of ratio analysis as well:

Inflation

2