Hecm tenure payment plan Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Hecm tenure payment plan? On this page you'll find 32 study documents about Hecm tenure payment plan.

Page 2 out of 32 results

Sort by

-

HECM Practice exam questions and answers

- Exam (elaborations) • 17 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

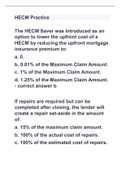

HECM Practice exam questions and answers The HECM Saver was introduced as an option to lower the upfront cost of a HECM by reducing the upfront mortgage insurance premium to: a. 0. b. 0.01% of the Maximum Claim Amount. c. 1% of the Maximum Claim Amount. d. 1.25% of the Maximum Claim Amount. - ANSWERS b If repairs are required but can be completed after closing, the lender will create a repair set-aside in the amount of: a. 15% of the maximum claim amount. b. 100% of the actual cos...

-

HECM Practice Questions and Answers 100% Pass

- Exam (elaborations) • 29 pages • 2024

-

- $12.49

- + learn more

HECM Practice Questions and Answers 100% Pass The HECM Saver was introduced as an option to lower the upfront cost of a HECM by reducing the upfront mortgage insurance premium to: a. 0. b. 0.01% of the Maximum Claim Amount. c. 1% of the Maximum Claim Amount. d. 1.25% of the Maximum Claim Amount. - Answer- b If repairs are required but can be completed after closing, the lender will create a repair set-aside in the amount of: a. 15% of the maximum claim amount. b. 100% of the actual co...

-

HECM Exam questions and correct answer

- Exam (elaborations) • 14 pages • 2024

- Available in package deal

-

- $13.99

- + learn more

HECM Exam questions and correct answers A reverse mortgage is... - ANSWERS a loan against the value of a home that provides cash advances to a borrower, requiring no repayment until a future time. A reverse mortgage is different from a home equity loan because - ANSWERS You do not have to make monthly repayments on a reverse mortgage A reverse mortgage must be repaid - ANSWERS When the last eligible borrower dies, sells, or permanently moves away The purpose of a reverse mortgage is mo...

-

Mortgage Loan Products and Terms/Final Study Set (A+ Graded)

- Exam (elaborations) • 15 pages • 2023

-

Available in package deal

-

- $9.99

- + learn more

HECM Tenure payment plan correct answers Equal monthly payments continue for the life of the borrower as long as one borrower lives and continues to occupy the property as principal residence HECM Term payment plan correct answers Equal monthly payments for a fixed period of months selected HECM Line of Credit payment plan correct answers Borrowers withdraw money as needed. Unscheduled payments or in installments, at times and in an amount of your choosing until the line of credit is exhau...

-

HECM Exam questions and correct answers

- Exam (elaborations) • 14 pages • 2024

- Available in package deal

-

- $13.99

- + learn more

HECM Exam questions and correct answers A reverse mortgage is... - ANSWERS a loan against the value of a home that provides cash advances to a borrower, requiring no repayment until a future time. A reverse mortgage is different from a home equity loan because - ANSWERS You do not have to make monthly repayments on a reverse mortgage A reverse mortgage must be repaid - ANSWERS When the last eligible borrower dies, sells, or permanently moves away The purpose of a reverse mortgage is mo...

-

HECM Test Practice Questions |Questions with 100% Correct Answers | Updated & Verified 2024

- Exam (elaborations) • 21 pages • 2024

-

- $12.49

- + learn more

HECM Test Practice Questions |Questions with 100% Correct Answers | Updated & Verified 2024 The HECM Saver was introduced as an option to lower the upfront cost of a HECM by reducing the upfront mortgage insurance premium to: a. 0. b. 0.01% of the Maximum Claim Amount. c. 1% of the Maximum Claim Amount. d. 1.25% of the Maximum Claim Amount. - answerb If repairs are required but can be completed after closing, the lender will create a repair set-aside in the amount of: a. 15% of the ma...

-

HECM Practice| 128 questions| with complete solutions

- Exam (elaborations) • 17 pages • 2023

-

Available in package deal

-

- $12.99

- + learn more

The HECM Saver was introduced as an option to lower the upfront cost of a HECM by reducing the upfront mortgage insurance premium to: a. 0. b. 0.01% of the Maximum Claim Amount. c. 1% of the Maximum Claim Amount. d. 1.25% of the Maximum Claim Amount. correct answer: b If repairs are required but can be completed after closing, the lender will create a repair set-aside in the amount of: a. 15% of the maximum claim amount. b. 100% of the actual cost of repairs. c. 100% of the estimated...

-

HECM test bank questions correctly answered 2023

- Exam (elaborations) • 17 pages • 2023

- Available in package deal

-

- $26.99

- + learn more

HECM test bank questions correctly answered 2023The HECM Saver was introduced as an option to lower the upfront cost of a HECM by reducing the upfront mortgage insurance premium to: a. 0. b. 0.01% of the Maximum Claim Amount. c. 1% of the Maximum Claim Amount. d. 1.25% of the Maximum Claim Amount. b If repairs are required but can be completed after closing, the lender will create a repair set-aside in the amount of: a. 15% of the maximum claim amount. b. 100% of the actual cost of...

-

HECM Practice exam questions and answers

- Exam (elaborations) • 17 pages • 2024

- Available in package deal

-

- $13.99

- + learn more

HECM Practice exam questions and answers The HECM Saver was introduced as an option to lower the upfront cost of a HECM by reducing the upfront mortgage insurance premium to: a. 0. b. 0.01% of the Maximum Claim Amount. c. 1% of the Maximum Claim Amount. d. 1.25% of the Maximum Claim Amount. - ANSWERS b If repairs are required but can be completed after closing, the lender will create a repair set-aside in the amount of: a. 15% of the maximum claim amount. b. 100% of the actual cos...

-

HECM Practice with 100% correct answers

- Exam (elaborations) • 68 pages • 2023

-

Available in package deal

-

- $12.99

- + learn more

The HECM Saver was introduced as an option to lower the upfront cost of a HECM by reducing the upfront mortgage insurance premium to: a. 0. b. 0.01% of the Maximum Claim Amount. c. 1% of the Maximum Claim Amount. d. 1.25% of the Maximum Claim Amount. b If repairs are required but can be completed after closing, the lender will create a repair set-aside in the amount of: a. 15% of the maximum claim amount. b. 100% of the actual cost of repairs. c. 100% of the estimated cost of repa...

That summary you just bought made someone very happy. Also get paid weekly? Sell your study resources on Stuvia! Discover all about earning on Stuvia