Qualifying child test - Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Qualifying child test? On this page you'll find 636 study documents about Qualifying child test.

Page 3 out of 636 results

Sort by

-

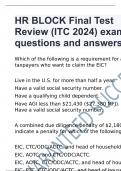

HR BLOCK Final Test Review (ITC 2024) exam questions and answers

- Exam (elaborations) • 31 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC/ODC/ACTC. EIC, AOTC, CTC/ODC/ACTC, and head ...

-

HR Block 2023 Scenarios Exam Questions and Answers

- Exam (elaborations) • 20 pages • 2023

- Available in package deal

-

- $12.49

- + learn more

HR Block 2023 Scenarios Exam Questions and Answers Carolyn earned $52,000 as a full-time employee in 2018. Due to procrastination and denial, she did not prepare her 2018 income tax return until June 23, 2019. Carolyn did not file the return until August 1, 2019. She did not request an extension of time to file. Her return showed a balance due of $1,500. What is her penalty? - ANS ️️ The IRS assesses a late filing penalty for four months. Carolyn's penalty is $300 [5% x 4 x $1,500]. ...

-

RTRP Exam questions and answers 2024

- Exam (elaborations) • 16 pages • 2024

- Available in package deal

-

- $14.99

- + learn more

"Considered unmarried" - Files separate return - TP pays >1/2 upkeep home - TP's spouse did not live in home last 6 mos - TP's home main home for qualifying child for >1/2 year - TP is eligible to claim regardless of whether dependency exemption is actually claimed U.S Citizen Person born in U.S. Born outside U.S. where one parent is U.S. citizen at time of birth Naturalized citizen Automatic 2 month extension to file TPs living outside the U.S. and Puerto Ric...

-

Enrolled Agent - Exam Questions and Answers Latest Update

- Exam (elaborations) • 43 pages • 2024

-

Available in package deal

-

- $21.49

- + learn more

Qualifying Child Test - Answer-1. Relationship Test 2. Age Test 3. Residence Test 4. Support Test W-2G - Answer-Certain Gambling Winnings Form 1099-B - - Answer-Proceeds from Broker and Barter Exchange Transactions Form 1099-C - - Answer-Cancellation of Debt Form 1099-DIV - - Answer-Dividends and Distributions Form 1099-G - - Answer-Certain Government Payments Form 1099-INT - Answer-Interest Income Form 1099-MISC - - Answer-Miscellaneous Income Rents, Prize awards, Cro...

-

H&R Block Final Exam And Answers Graded A+ 2024.

- Exam (elaborations) • 12 pages • 2024

-

Available in package deal

-

- $8.39

- + learn more

Tony (28) and Adam (27) are cousins and lived in the same home throughout 2017. Adam only earned $2,500 in 2017. Tony earned $25,000 in 2017. What test does he meet? - Answer Adam meets the relationship and member of household test for Tony, since Adam lived with Tony the entire year. Tony may be able to claim Adam as a qualifying relative dependent. Note: Being cousins alone will not meet the relationship test for qualifying relative, because a cousin is not listed as a specific relati...

-

H&R Block Final review|Graded A+

- Exam (elaborations) • 10 pages • 2024

-

- $13.50

- + learn more

H&R Block Final review|Graded A+ Tony (28) and Adam (27) are cousins and lived in the same home throughout 2017. Adam only earned $2,500 in 2017. Tony earned $25,000 in 2017. What test does he meet? Adam meets the relationship and member of household test for Tony, since Adam lived with Tony the entire year. Tony may be able to claim Adam as a qualifying relative dependent. Note: Being cousins alone will not meet the relationship test for qualifying relative, because a cousin is not list...

-

HR BLOCK Final Test Review (ITC 2024) Questions and Answers Already Passed

- Exam (elaborations) • 34 pages • 2024

- Available in package deal

-

- $10.99

- + learn more

HR BLOCK Final Test Review (ITC 2024) Questions and Answers Already Passed Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household...

-

LSU ACCT 3221 Chapter 2 | Questions and Answers

- Exam (elaborations) • 9 pages • 2024

-

Available in package deal

-

- $15.49

- + learn more

LSU ACCT 3221 Chapter 2 | Questions and Answers True/False: The federal individual income tax returns are the 1040ES, 1040A and 1040. False True/False: The tax code defines adjusted gross income (AGI) as gross income minus a list of permitted deductions. True True/False: The amount of tax liability for a taxpayer depends on many factors, including the filing status of the taxpayer. True True/False: A married couple can file a joint return if they are married and if both have earned income. Fal...

-

Enrolled Agent - Exam 1 2023 with 100% correct answers

- Exam (elaborations) • 54 pages • 2023

-

Available in package deal

-

- $15.49

- + learn more

Qualifying Child Test - correct answer -1. Relationship Test 2. Age Test 3. Residence Test 4. Support Test W-2G - correct answer -Certain Gambling Winnings Form 1099-B - - correct answer -Proceeds from Broker and Barter Exchange Transactions Form 1099-C - - correct answer -Cancellation of Debt Form 1099-DIV - - correct answer -Dividends and Distributions Form 1099-G - - correct answer -Certain Government Payments Form 1099-INT - correct answer -Interest Income Form 1099-M...

-

VITA 2024 ADVANCED TEST EXAM QUESTIONS AND ANSWERS LATEST UPDATE 2024/2025 (100% SOLVED)

- Exam (elaborations) • 13 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

VITA 2024 ADVANCED TEST EXAM QUESTIONS AND ANSWERS LATEST UPDATE 2024/2025 (100% SOLVED) What is the most advantageous filing status allowable that Joe can claim on his taxreturn for 2021? Head of Household Joe can claim a higher standard deduction because he is blind. True Chris and Marcie cannot claim the Earned Income Tax Credit (EITC) because theyare too young and have no qualifying children. false Chris and Marcie must claim the EIP3 of $2,800 as taxable income on their 2021 t...

Do you wonder why so many students wear nice clothes, have money to spare and enjoy tons of free time? Well, they sell on Stuvia! Imagine your study notes being downloaded a dozen times for $15 each. Every. Single. Day. Discover all about earning on Stuvia