Did you comply with w Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Did you comply with w? On this page you'll find 277 study documents about Did you comply with w.

Page 4 out of 277 results

Sort by

-

H&R Block Income Tax Course Exam Study Guide with complete Solutions Latest Updated 2023/2024

- Exam (elaborations) • 42 pages • 2023

- Available in package deal

-

- $12.99

- + learn more

Circular 230 - Correct Answer Regulations governing the practice of attorneys, certified public accountants, enrolled agents, enrolled actuaries, and appraisers before the IRS. Disclosure - Correct Answer The release of tax information by an IRS employee. Due Diligence - Correct Answer Requirements that tax professionals must follow when preparing income tax returns. Noncompliance - Correct Answer Failure or refusal to comply with the tax code. Privilege - Correct Answer Protection f...

-

H&R Block Income Tax Course Study Questions with Answers

- Exam (elaborations) • 42 pages • 2024

-

Available in package deal

-

- $10.99

- + learn more

Circular 230 Regulations governing the practice of attorneys, certified public accountants, enrolled agents, enrolled actuaries, and appraisers before the IRS. Disclosure The release of tax information by an IRS employee. Due Diligence Requirements that tax professionals must follow when preparing income tax returns. Noncompliance Failure or refusal to comply with the tax code. Privilege Protection from being required to disclose confidential communications between two parties, such ...

-

H&R Block Income Tax Course Test Preparation Questions with Answers

- Exam (elaborations) • 42 pages • 2024

-

Available in package deal

-

- $15.49

- + learn more

Circular 230 Regulations governing the practice of attorneys, certified public accountants, enrolled agents, enrolled actuaries, and appraisers before the IRS. Disclosure The release of tax information by an IRS employee. Due Diligence Requirements that tax professionals must follow when preparing income tax returns. Noncompliance Failure or refusal to comply with the tax code. Privilege Protection from being required to disclose confidential communications between two parties, such ...

-

LEV3701 SUMMARY NOTES

- Exam (elaborations) • 34 pages • 2023

-

Available in package deal

-

- $2.81

- 1x sold

- + learn more

LEV Notes Law of Evidence (University of South Africa) lOMoARcPSD| WITNESSES 2 aspects of oral evidence: 1. COMPETENCE OF WITNESS TO TESTIFY Whether person has mental capacity to testify – if not, they are not competent to testify & court cannot hear their evidence under any circumstances Note the diff btw admissibility and competence: - Admissibility = evidence of a person who is already a competent witness - Competence = focuses on the person Parties cannot consent to admission o...

-

HESI COMPREHENSIVE REVIEW (NCLEX RN) EXAM 5TH ED LATEST 2023

- Exam (elaborations) • 772 pages • 2023

-

- $47.99

- 1x sold

- + learn more

LATEST 2023 HESI COMPREHENSIVE REVIEW (NCLEX RN) EXAM 5TH ED QUESTIONS & ANSWERS WITH EXPLANATIONS (GUARANTEED A++) HESI Comprehensive Review for the NCLEX-RN® Examination FIFTH EDITION Editor E. Tina Cuellar, PhD, WHNP, PMHCNS, BC Director of Curriculum, Review and Testing, Elsevier/HESI, Houston, Texas Table of Contents Cover image Title page Copyright Contributing Authors Reviewers Preface 1. Introduction to Testing and the NCLEX-RN® Examination Test-Taking Tips The NCL...

-

CPAER Quiz Cleanup Questions with Answers All Correct

- Exam (elaborations) • 28 pages • 2024

-

Available in package deal

-

- $12.39

- + learn more

CPAER Quiz Cleanup Questions with Answers All Correct In order to act as pilot-in-command of a single-engine aircraft for an air taxi service under night VFR without passengers a commercial pilot must have A.competency check. B.a valid instrument rating and PPC. C.a valid night rating and competency check. D.none of the above. - Answer-A Reference: CARS 703.88 Night rating is included in the CPL; no need for separate rating. Chevron markings preceding a runway threshold indicates that...

-

MRL3701 PORTFOLIO MEMO - OCT./NOV. 2023 - SEMESTER 2 - UNISA - DUE 26 OCTOBER 2023 - DETAILED ANSWERS WITH FOOTNOTES & BIBLIOGRAPHY- DISTINCTION GUARANTEED!

- Exam (elaborations) • 18 pages • 2023

-

- $17.73

- + learn more

MRL3701 PORTFOLIO MEMO - OCT./NOV. 2023 - SEMESTER 2 - UNISA - DUE 26 OCTOBER 2023 - DETAILED ANSWERS WITH FOOTNOTES & BIBLIOGRAPHY- DISTINCTION GUARANTEED! Question 1 CONFIDENTIAL 8 of 11 1.1 Explain when a formal defect in an application for the sequestration of an insolvent estate will be considered as fatal. (5) 1.2 Explain why the court in Ex Parte Arntzen (Nedbank Ltd as Intervening Creditor) 2013 (1) SA 49 (KZP) held that creditors are more vulnerable in voluntary surrender appli...

-

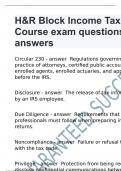

H&R Block Income Tax Course exam questions and answers

- Exam (elaborations) • 81 pages • 2024

-

- $13.99

- + learn more

Circular 230 Regulations governing the practice of attorneys, certified public accountants, enrolled agents, enrolled actuaries, and appraisers before the IRS. Disclosure The release of tax information by an IRS employee. Due Diligence Requirements that tax professionals must follow when preparing income tax returns. Noncompliance Failure or refusal to comply with the tax code. Privilege Protection from being required to disclose confidential communications betwe...

-

H&R Block Income Tax Course Questions with 100% Correct Answers

- Exam (elaborations) • 42 pages • 2023

-

- $12.99

- + learn more

Circular 230 Correct Answer Regulations governing the practice of attorneys, certified public accountants, enrolled agents, enrolled actuaries, and appraisers before the IRS. Disclosure Correct Answer The release of tax information by an IRS employee. Due Diligence Correct Answer Requirements that tax professionals must follow when preparing income tax returns. Noncompliance Correct Answer Failure or refusal to comply with the tax code. Privilege Correct Answer Protection from being ...

-

ANNUAL ETHICS TESTBANK 2024 LATEST UPDATE(EVERYTHING YOU NEED TO KNOW IN ONE PLACE)100% VERIFIED FOR ACCURACY(WITH ACCURATE EXPERT SOLUTIONS)ALREADY GRADED A+(50+ QUESTIONS AND ANSWERS)

- Exam (elaborations) • 13 pages • 2024

-

- $16.99

- + learn more

for the holidays, one of your contractor employees gives you a book on Navy history. the book retails for $24.95, but since his company bought it in bulk, it only cost them $19.95. May you keep it? - answer no unless you pay the contractor the fair market price of $24.95 rob and Margaret have been friends for over 10 years. for their birthdays, they each treat each other to a special steak dinner. Rob works for NAVSEA... - answer yes, because the gift is motivated by personal relationship...

That summary you just bought made someone very happy. Also get paid weekly? Sell your study resources on Stuvia! Discover all about earning on Stuvia