Qualifying child - Study guides, Class notes & Summaries

Looking for the best study guides, study notes and summaries about Qualifying child? On this page you'll find 1326 study documents about Qualifying child.

Page 4 out of 1.326 results

Sort by

-

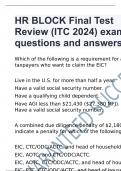

HR BLOCK Final Test Review (ITC 2024) exam questions and answers

- Exam (elaborations) • 31 pages • 2024

- Available in package deal

-

- $13.49

- + learn more

Which of the following is a requirement for all taxpayers who want to claim the EIC? Live in the U.S. for more than half a year. Have a valid social security number. Have a qualifying child dependent. Have AGI less than $21,430 ($27,380 MFJ). Have a valid social security number. A combined due diligence penalty of $2,180 would indicate a penalty for which of the following? EIC, CTC/ODC/ACTC, and head of household. EIC, AOTC, and CTC/ODC/ACTC. EIC, AOTC, CTC/ODC/ACTC, and head ...

-

HRB FINAL EXAM WITH COMPLETE SOLUTIONS

- Exam (elaborations) • 28 pages • 2024

-

- $13.49

- + learn more

HRB FINAL EXAM WITH COMPLETE SOLUTIONS What is the Difference between earned income and unearned income? - Answer ️️ -Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment of money or other property, such as interest, dividends, and royalties. It also includes pensions alimony, unempl...

-

RTRP - IRS REGISTERED TAX RETURN PREPARER TEST EXAM 2024 WITH ACCURATE SOLUTIONS

- Exam (elaborations) • 22 pages • 2024

-

- $18.49

- + learn more

1. For purposes of the Earned Income Credit, a qualifying child is a child who... A. is over age 24 at the end of the calendar year and not permanently and totally disabled B. has lived with you in the United States for at least 12 months C. is filing a joint return D. meets the relationship test EXPLANATION Answer: D - Meets the relationship test. 2. A taxpayer should itemize deductions if the taxpayer’s total itemized deductions are... A. less than the taxpayer’s interest ...

-

TAX2000 Midterm Review Questions and Answers Grade A+

- Exam (elaborations) • 14 pages • 2024

-

- $13.49

- + learn more

What are the various IRS Tax forms that must be used to file for each different taxpayer? Individual: 1040EZ, 1040A, 1040, 1040X (amendments) Corporations: 1120, 1120S ( S Corp. status) Partners: 1065 ( For reporting only, not taxable) Self-Employed: 1040 ES (Schedule SE and Schedule C) What types of relatives meet the relationship test for dependency exemption rule? Child, stepchild, adopted child/sibling, half/step-sibling, descendant of any of the above, foster child. ( Chil...

-

HRB FINAL EXAM 2023-2024 COMPLETE QUESTIONS AND ANSWERS ASSURED A+.

- Exam (elaborations) • 23 pages • 2023

-

- $12.99

- + learn more

HRB FINAL EXAM COMPLETE QUESTIONS AND ANSWERS ASSURED A+. What is the Difference between earned income and unearned income? - Answer Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment of money or other property, such as interest, dividends, and royalties. It also includes pensions ali...

-

LSU ACCT 3221 Chapter 2 | Questions and Answers

- Exam (elaborations) • 9 pages • 2024

-

Available in package deal

-

- $15.49

- + learn more

LSU ACCT 3221 Chapter 2 | Questions and Answers True/False: The federal individual income tax returns are the 1040ES, 1040A and 1040. False True/False: The tax code defines adjusted gross income (AGI) as gross income minus a list of permitted deductions. True True/False: The amount of tax liability for a taxpayer depends on many factors, including the filing status of the taxpayer. True True/False: A married couple can file a joint return if they are married and if both have earned income. Fal...

-

H&R Block Income Tax Course Final Exam || All Questions & Answers (Graded 100%)

- Exam (elaborations) • 24 pages • 2023

-

Available in package deal

-

- $13.99

- + learn more

H&R Block Income Tax Course Final Exam || All Questions & Answers (Graded 100%) H&R Block Income Tax Course Final Exam || All Questions & Answers (Graded 100%) What is the Difference between earned income and unearned income? - ANSWER - Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment ...

-

HRB FINAL EXAM 2023-2024 COMPLETE QUESTIONS AND ANSWERS ASSURED A+.

- Exam (elaborations) • 23 pages • 2023

-

- $12.99

- + learn more

HRB FINAL EXAM COMPLETE QUESTIONS AND ANSWERS ASSURED A+. What is the Difference between earned income and unearned income? - Answer Earned income is received for services performed. Examples are wages commissions, tips and generally farming and other business income . Taxable income other than that received for services performed. Unearned Income includes money received ro the investment of money or other property, such as interest, dividends, and royalties. It also includes pensions ali...

-

H&R Block Final review 2024 GRADED A

- Exam (elaborations) • 10 pages • 2024

-

Available in package deal

-

- $11.49

- + learn more

Tony (28) and Adam (27) are cousins and lived in the same home throughout 2017. Adam only earned $2,500 in 2017. Tony earned $25,000 in 2017. What test does he meet? Adam meets the relationship and member of household test for Tony, since Adam lived with Tony the entire year. Tony may be able to claim Adam as a qualifying relative dependent. Note: Being cousins alone will not meet the relationship test for qualifying relative, because a cousin is not listed as a specific relative relations...

-

EA exam part1 exam 2023 with 100% correct answers

- Exam (elaborations) • 22 pages • 2023

-

Available in package deal

-

- $16.49

- + learn more

tax filing flow - correct answer -filing requirement and status -income - income exclusion - adjust to income AGI (schedule1) - deduction - taxable income and taxation - additional tax (schedule2) - credits (schedule3) - payment (withholding) or refund qualifying relative - correct answer -1. living together all year OR a family member (no foster parents, no cousins) 2. cannot be a qualifying child 3. not provide over half of own support 4. person's GI less than 4300 qualifying child -...

Study stress? For sellers on Stuvia, these are actually golden times. KA-CHING! Earn from your study resources too and start uploading now. Discover all about earning on Stuvia