Chapter 2 Financial Statements, Sales

for Planning and Control

Exercises

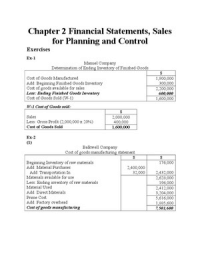

Ex-1

Manuel Company

Determination of Ending Inventory of Finished Goods

$

Cost of Goods Manufactured 1,900,000

Add: Beginning Finished Goods Inventory 300,000

Cost of goods available for sales 2,200,000

Less: Ending Finished Goods Inventory 600,000

Cost of Goods Sold (W-1) 1,600,000

W-1 Cost of Goods sold:

$

Sales 2,000,000

Less: Gross Profit (2,000,000 x 20%) 400,000

Cost of Goods Sold 1,600,000

Ex-2

(1)

Balkwell Company

Cost of goods manufacturing statement

$ $

Beginning Inventory of raw materials 176,000

Add: Material Purchases 2,400,000

Add: Transportation In 32,000 2,432,000

Materials available for use 2,628,000

Less: Ending inventory of raw materials 196,000

Material Used 2,412,000

Add: Direct Materials 3,204,000

Prime Cost 5,616,000

Add: Factory overhead 1,885,600

Cost of goods manufacturing 7,501,600

,(2)

Balkwell Company

Cost of goods manufactured statement

$

Cost of Goods Manufacturing 7,501,600

Add: Beginning Work in process Inventory 129,800

Total cost put into process 7,631,400

Less: Ending Work in process inventory 136,800

Cost of goods manufactured 7,494,600

(3)

Balkwell Company

Cost of goods sold statement

$

Cost of Goods Manufactured 7,494,600

Add: Beginning Finished Goods Inventory 620,000

Cost of goods available for sales 8,114,600

Less: Ending Finished Goods Inventory 467,400

Cost of Goods Sold 7,647,200

Ex-3 (1)

Ruthven Company

Cost of goods sold statement

$

Beginning inventory of raw materials 8,000

Add: purchases 36,000

Material available for use 44,000

Less: Ending inventory of raw materials 8,500

Material used 35,500

Add: Direct labour 15,000

Prime cost 50,500

Add: Factory overhead 10,000

Cost of goods manufacturing 60,500

Add: Beginning work in process inventory 8,000

Total cost put into process 68,500

Less: Ending work in process inventory 15,000

Cost of goods manufactured 53,500

Add: Beginning Finished goods inventory 7,000

Cost of goods available for sales 60,500

Less: Ending Finished goods inventory 10,200

Cost of goods sold 50,300

,(2)

Ruthven Company

Income statement

$ $

Sales 72,000

Less: Cost of goods sold 50,300

Gross profit 21,700

Less: Operating expenses

Marketing expenses 3,600

Administrative expenses 720 4,320

Net operating income 17,380

Less: Other expenses 360

Net Income 17,020

Ex-4 (1)

Crowley Inc.,

Cost of goods sold statement

$

Beginning inventory of raw materials 7,000

Add: purchases 42,300

Material available for use 49,300

Less: Ending inventory of raw materials 7,400

Material used 41,900

Add: Direct labour 30,000

Prime cost 71,900

Add: Factory overhead 45,000

Cost of goods manufacturing 116,900

Add: Beginning work in process inventory 9,600

Total cost put into process 126,500

Less: Ending work in process inventory 13,000

Cost of goods manufactured 113,500

Add: Beginning Finished goods inventory 15,000

Cost of goods available for sales 128,500

Less: Ending Finished goods inventory 17,500

Cost of goods sold 111,000

,(2)

Crowley Inc.,

Income statement

$ $

Sales 182,000

Less: Cost of goods sold 111,000

Gross profit 71,000

Less: Operating expenses

Marketing expenses 14,100

Administrative expenses 22,900 37,000

Net Income 34,000

Ex-5 (1)

The Shelikoff Company

Income Statement

For the year ended December 31, 19--.

$ $

Sales 314,000

Less: Cost of goods sold:

Beginning Inventory of Raw Materials 3,800

Add: Purchases 140,000

Materials available for use 143,800

Less: Ending Inventory of Raw Materials 4,300

Material Used 139,500

Add: Direct Labour 67,350

Prime Cost 206,850

Add: Factory Overhead (50% of Direct Labour) 33,675

Cost of goods Manufacturing 240,525

Add: Beginning Work in process Inventory 4,600

Total cost put into process 245,125

Less: Ending Work in process Inventory 6,200

Cost of goods Manufactured 238,925

Add: Beginning Finished Goods Inventory 5,900

Cost of goods available for sales 244,825

Less: Ending Finished Goods Inventory 9,270 235,555

Cost of goods sold 78,445

Gross Profit

Less: Operating expenses

Marketing Expenses 23,115

Administrative expenses 17,650 40,765

Net Income 37,680

,(2)

Percentage of Net Income to Sales = Net Income / Sales x 100

= 37,,000 x 100

= 12% of Sales

Ex-6

Metaxen Corporation,

Cost of goods sold statement

$

Beginning inventory of raw materials 88,000

Add: purchases 366,000

Add: Freight on materials purchased 6,600

Material available for use 460,600

Less: Ending inventory of raw materials 64,000

Material used 396,600

Add: Direct labour 523,600

Prime cost 920,200

Add: Factory overhead (excluding depreciation) 468,400

Add: Depreciation (W-1) 104,400

Cost of goods manufacturing 1,493,000

Add: Beginning work in process inventory 29,800

Total cost put into process 1,522,800

Less: Ending work in process inventory 38,800

Cost of goods manufactured 1,484,000

Add: Beginning Finished goods inventory 44,200

Cost of goods available for sales 1,528,200

Less: Ending Finished goods inventory 66,000

Cost of goods sold 1,462,200

W-1 Depreciation Charged to Cost of Goods Sold:

Total Depreciation = $ 116,000

Depreciation charged to Cost of goods sold = $116,000 x 90% = $ 104,400

,Ex-7

Brockway Corporation,

Cost of goods sold statement

$

Beginning inventory of raw materials 90,000

Add: purchases 198,000

Material available for use 288,000

Less: Ending inventory of raw materials 95,000

Material used 193,000

Add: Direct labour 224,000

Prime cost 417,000

Add: Factory overhead 167,000

Cost of goods manufacturing 584,000

Add: Beginning work in process inventory 70,000

Total cost put into process 654,000

Less: Ending work in process inventory 80,000

Cost of goods manufactured 574,000

Add: Beginning Finished goods inventory 110,000

Cost of goods available for sales 684,000

Less: Ending Finished goods inventory 95,000

Cost of goods sold 589,000

Ex-8 (1)

Reinecke Inc.,

Cost of goods sold statement

$

Material used 440,000

Add: Direct labour 290,000

Prime cost 730,000

Add: Factory overhead (W-1) 89,760

Cost of goods manufacturing 819,760

Add: Beginning work in process inventory 41,200

Total cost put into process 860,960

Less: Ending work in process inventory 42,500

Cost of goods manufactured 818,460

Add: Beginning Finished goods inventory 34,300

Cost of goods available for sales 852,760

Less: Ending Finished goods inventory 31,500

Cost of goods sold 821,260

,W-1 Factory Overhead:

$

Indirect labour 46,000

Light & power 4,260

Depreciation 4,700

Repairs to machinery 5,800

Miscellaneous factory overhead 29,000

Factory Overhead: 89,760

(2)

Unit cost of goods manufactured = Cost of goods manufactured/ Units produced

= $ 818,,000

= $ 45.47 per unit

(3)

$

Applied Factory overhead (30% of $ 290,000) 87,000

Actual Factory overhead 89,760

Under applied factory overhead 2,760

Ex-9 (1)

Unit cost of finished goods inventory, December 31

= Cost of goods manufactured (W-1)/ Units produced during the year (W-2)

= $ 706,,000

= $ 176.65 per unit

W-1

White Corporation,

Cost of goods sold statement

$

Beginning inventory of raw materials 34,200

Add: purchases (W-1.1) 367,400

Material available for use 401,600

Less: Ending inventory of raw materials 49,300

Material used 352,300

Add: Direct labour 162,500

Prime cost 514,800

Add: Factory overhead (W-1.2) 152,650

Cost of goods manufacturing 667,450

Add: Beginning work in process inventory 81,500

Total cost put into process 748,950

Less: Ending work in process inventory 42,350

Cost of goods manufactured 706,600

,W 1.1 Purchases:

$

Purchases 364,000

Add: Freight in 8,600

Less: Purchases Discounts 5,200

Net Purchases including direct expenses 367,400

W 1.2 Factory overhead:

$

Indirect labour 83,400

Depreciation- Factory equipment 21,350

Miscellaneous factory overhead 47,900

Factory overhead 152,650

W-2 No. of Units Manufactured

Units

Ending finished goods 420

Add: units sold 3,880

4,300

Less: Beginning finished goods 300

Number of units manufactured 4,000

(2)

Total cost of finished goods inventory

= Units in finished goods inventory x unit cost of units manufactured

= 420 x $ 176.65

= $ 74,193

(3)

White Corporation,

Cost of goods sold statement

$

Cost of goods manufactured 706,600

Add: Beginning Finished goods inventory 48,600

Cost of goods available for sales 755,200

Less: Ending Finished goods inventory 74,193

Cost of goods sold 681,007

,(4)

White Corporation,

Income statement

$

Sales (3,880 units x $ 220 per unit) 853,600

Less: Cost of goods sold 681,007

Gross Profit 172,593

Unit Gross Profit = Gross Profit / Units sold

= $ 172,,880

= $ 44.48

Ex-10

Rate of return on capital employed

= Net income / capital employed x 100

= $ 40,000 / $ 400,000 x 100

= 10%

Ex-11

$ $

Sales (W-1) 12,000,000

Less: Cost of goods sold (balancing figure) 7,200,000

Gross Profit (40% of Sales) 4,800,000

Less: Operating expenses:

Selling & marketing expenses (15% of sales) 1,800,000

Administrative expenses (balancing figure) 1,762,500 3,562,500

Net operating income 1,237,500

Less: financial expenses (W-2) 37,500

Net income before tax 1,200,000

W-1 Sales:

Pretax income to sales = 10% of sales

Pretax income in $ = 1,200,000

Hence, 10% of sales = $ 1,200,000

Sales = $ 1,200,000/ 0.10

= $ 12,000,000

W-2 Financial expenses

Total Liabilities = $ 2,000,000

Bonds Payable = 37.5% of 2,000,000

= $ 750,000

Interest Expense = $ 750,000 x 5% = $ 37,500

, Ex-12 (1)

Yukon Refrigerator Company

Income Statement

For the year ended March 31, 19--.

$ $

Sales 6,634,000

Less: Cost of goods sold:

268,000

Beginning Inventory of Raw Materials

1,946,700

Add: Purchases

Materials available for use 2,214,700

Less: Ending Inventory of Raw Materials 167,000

Material Used 2,047,700

Add: Direct Labour 2,125,800

Prime Cost 4,173,500

Add: Factory Overhead 764,000

Cost of goods Manufactured 4,937,500

Add: Beginning Finished Goods Inventory 43,000

Cost of goods available for sales 4,980,500

Less: Ending Finished Goods Inventory (200x395) 79,000 4,901,500

Cost of goods sold 1,732,500

Gross Profit

Less: Operating expenses

Marketing Expenses 516,000

Administrative expenses 461,000 977,000

Net Income 755,500

(2)

No. of Units Manufactured

Units

Ending finished goods 200

Add: units sold 12,400

12,600

Less: Beginning finished goods 100

Number of units manufactured 12,500

(3)

Unit cost of finished goods inventory

= Cost of goods manufactured / Units produced during the year

= $ 4,937,,500

= $ 395 per unit