Topic 1.2: Credit Risk Intro

Credit risk is the risk that changes in the credit quality of counterparties or issuers of securities affect

the value of the portfolios. It includes losses due to default and market losses due to deteriorating

credit quality.

Applications of credit risk models can roughly be split into two domains:

1. Pricing of credit risky securities such as corporate bonds, derivatives, credit default swaps.

2. Risk capital management: computation of loss distribution and associated risk measures such

as Expected Shortfall.

Managing credit risk is similar to other market risks, however there are some specific challenges such

as: lack of public information on credit quality, strongly skewed loss distributions with heavy tails

(leading to frequent small gains and occasional large losses) and the modelling of dependence is

crucial since the tail of the loss distribution is strongly influenced by default dependency

assumptions.

Topic 1.3: Merton’s Model

Merton’s model says that when a company cannot repay its debts (the current value of its assets is

lower than its liabilities), it will go into default. The specifications of the model are shown below:

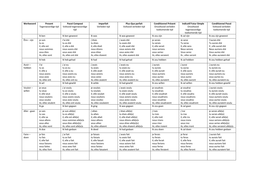

In the model, we essentially have two cases at time T:

The model above also explains the conflicts of interest between shareholders and debtholders. In the

upside case shareholders receive a large profit and in the downside there is a maximum loss they can

incur. On the other hand, the debtholders do not receive large upside potential, while they are

exposed to losses. So it might be in the interest of the shareholders to make the firm more risky,

while the debtholders actually want to mitigate the risks of the firm as much as possible.

,The additional setup of the model is shown below and it shows us that with the assumptions made

(that asset values follow a log-normal distribution), we now enter the Black-Scholes world, in which

we can use the Black-Scholes formula to price the equity and debt of the firm (minus sign in default

probability formula should be an equals sign):

In the BS formula, when the volatility of the underlying goes up, the value of a put option on the

underlying goes up. Thus we can also see the relation between volatility and debt value in the

formula above. When the volatility of the asset value 𝑉𝑡 goes up, the debt value goes down.

When looking at the relationship between the credit spread and volatility and time to maturity, we

can state that: when the volatility is high, there is a higher probability that you default, thus the

credit spread goes up and when the time to maturity goes up, the credit spread also goes up. One

shortcoming of Merton’s model is that the credit spread at lower time to maturity is modelled too

low for what is often observed in real life.

Topic 1.4: Default Dependency

Default dependency concerns the case where there are multiple risk exposures that have

dependencies between them. The model used to analyse default dependencies is given below:

Consider first the case where defaults happen independently, in this case we are essentially flipping a

coin and what comes out determines for each firm if they default or not. In this case the loss

distribution of a portfolio of N loans is given by the Binomial distribution (which converges to a

normal distribution as the observations go up, due to the central limit theorem):

,This gives us the following distribution in the case of 100 exposures and a 5 percent individual default

probability:

We may observe that the tail of this distribution is rather small and thus does not really do justice to

the real-life distributions of defaults, which actually have larger tails. The small tail is due to the

default dependencies not being modelled.

A flip-side of the above case is that there is a situation of perfect dependency, in which case either all

the obligors default (with probability p = 5%) or none of the obligors default (with probability 1 - p =

95%).

The X% VaR gives the number of defaults/loss that will not be exceeded in X% of the cases. It is good

to note that the VaR may in some cases not be a very meaningful statistic of risk, given that it takes

the value of 100 for all levels above 95% (for example in the above case).

Essentially, in the end we would still like to model the cases between perfect independence and

perfect dependence, so with some level of default dependency, but not perfect dependency.

, Topic 1.5: One Factor Model

The one factor model combines the knowledge from Merton’s model, that a firm may default, with

the knowledge that there may be default dependencies. The model’s setup is shown below:

The addition that is made in the one factor model, to Merton’s model is that a covariance matrix is

used to account for the default dependencies. To setup the model we additionally need to do the

following as shown below. By taking the inverse of the Gaussian distribution (𝜙 −1 ) on both sides, we

may obtain the individual default probability (𝑑𝑖 ):

Additionally, as shown above, we need to calibrate the correlation parameters, but if there are many

exposures, this becomes a lot very quickly (as the formula shows). This thus often is avoided by

introducing a small set of common factors (and only calibrate the correlations for these common

factors). We may setup the one-factor model as such:

An example of the Y common factor may be the economic environment, since when there is a crisis

occurring, for example, this influences a lot of underlying companies. An idiosyncratic risk

component is also modelled in this model, with the 𝜖𝑖 .