College aantekeningen

M&A corporate governance part 1

- Instelling

- Tilburg University (UVT)

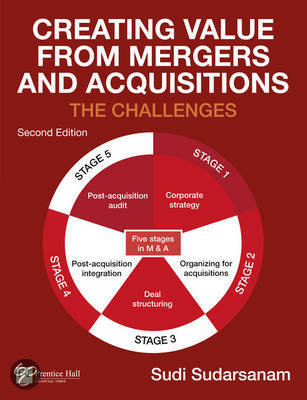

Lecture notes and slides in a nice overview from the course; corporate governance and restructuring. This is part 1 of the 2 given by Luc Renneboog on M&A

[Meer zien]