Chapter 5: Risk, Return, and the Historical Record

5.1 Determinants of the Level of Interest Rates

The level of interest rates is perhaps the most important macroeconomic factor to consider in one’s investment

analysis. Forecasts of interest rates directly determine expected returns in the fixed-income market.

We have a good understanding of the fundamental factors that determine the level of interest rates:

1. The supply of funds from savers, primarily households.

2. The demand for funds from businesses to be used to finance investments in plant, equipment, and

inventories (real assets or capital formation).

3. The government’s net demand for funds as modified by actions of the Federal Reserve Bank.

4. The expected rate of inflation.

Real and Nominal Rates of Interest

An interest rate is a promised rate of return denominated in some unit of account over some time period.

What the real return is, depends upon what your money can buy today relative to what you could buy when

you deposited the money.

Nominal interest rate: the growth rate of your money

Real interest rate: the growth rate of your purchasing power

1+ r nom

(5.1) 1+r real =

1+i

A common approximation to this relation is:

(5.2) r real ≈ r nom −1

Rearranging (5.1):

r nom −i

(5.3) r real =

1+i

Conventional fixed income investments promise a nominal rate of interest. You can only infer the expected real

rate on these investments by adjusting the nominal rate for your expectation of the rate of inflation.

The Equilibrium Real Rate of Interest

Three basic factors determine the real interest rate:

Supply

Demand

Government actions

The nominal interest rate is the real rate plus the expected rate of inflation.

The supply curve slopes up from left to right because the higher real interest rate, the greater the supply of

household savings.

At higher real interest rates, households will choose to postpone some current consumption.

The demand curve slopes down from left to right because the lower the real interest rate, the more businesses

will want to invest in physical capital.

1

,The government and central bank can shift these supply and demand curves either to the right or to the left

through fiscal and monetary policies.

The Equilibrium Nominal Rate of Interest

Irving Fischer argued that the nominal rate ought to increase one-for-one with expected inflation, E(i):

(5.4) r nom =r real + E(i)

When real interest rates are stable, changes in nominal rates ought to predict changes in inflation

rates.

Taxes and the Real Rate of Interest

Tax liabilities are based on nominal income and the tax rate determined by the investor’s tax bracket.

The real after-tax rate is approximately the after-tax nominal rate minus the inflation rate:

(5.5) r nom ( 1−t )−i=( r real +i )−i=r real ( 1−t )−it

Because you pay taxes on even the portion of interest earnings that is merely compensation for inflation, your

after-tax real returns falls by the tax rate times the inflation rate.

5.2 Comparing Rates of Return for Different Holding Periods

Zero-coupon bonds are sold at a discount form par value and provide their entire return from the difference

between the purchase price and the ultimate repayment of par value.

100

(5.6) r f ( T )= −1

P(T )

We typically express all investment returns as an effective annual rate (EAR), defined as the percentage

increase in funds invested over a 1-year horizon.

In general, we can relate EAR to the total return, r f(T), over a holding period of length T by using:

1 /T

(5.7) 1+ EAR=[ 1+r f ( T ) ]

Annual Percentage Rates

Annualized rates on short-term investments often are reported using simple rather than compound interest.

Annual percentage rates (APRs)

The relationship among the compounding period, the EAR, and the APR is:

n 1/ T

1+ EAR=[ 1+r f ( T ) ] =[ 1+ r f ( T ) ] = [ 1+T × APR ]

1/ T

(5.8)

Equivalently,

(1+ EAR )T −1

APR=

T

Continuous Compounding

As T approaches zero, we effectively approach continuous compounding (CC), and the relation of EAR to the

annual percentage rate, denoted by rcc for the continuously compounded case, is given by the exponential

function

2

,(5.9) 1+ EAR=exp ( r cc )=e r cc

To find rcc from the effective annual rate, we solve (5.9) for r cc as follows:

ln ( 1+ EAR )=r cc

ln() is the natural logarithm function, the inverse of exp().

The total return scales up in direct proportion to the time period, T.

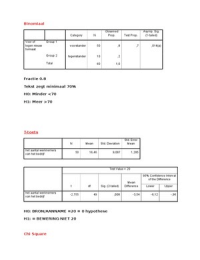

5.3 Bills and Inflation, 1926-2015

We divide the sample period at 1952. After that year, inflation is far less volatile, and, probably as a result, the

nominal interest rate tracks the inflation rate with far greater precision, resulting in a far more stable real

interest rate.

Dramatic reduction in the standard deviation of the real rate.

The lower standard deviation of the real rate in the post-1952 period reflects a similar decline in the standard

deviation of the inflation rate.

Fischer’s relation appears to work far better when inflation is itself more predictable and investors can more

accurately gauge the nominal interest rate they require to provide an acceptable real rate of return.

5.4 Risk and Risk Premiums

Holding-Period Returns

With an investment horizon of 1 year, the realized rate of return on your investment will depend on:

a. The price per share at year’s end; and

b. The cash dividends you will collect over the year.

Holding period return

Ending price of a share−Beginning price +Cash dividend

(5.10) HPR=

Beginning price

The percent return from dividends is called the dividend yield, and so dividend yield plus the rate of capital

gains equals HPR.

Expected Return and Standard Deviation

(5.11) E ( r )= ∑ p ( s ) r ( s )

s

The variance of the rate of return (2) is a measure of volatility. It measures the dispersion of possible

outcomes around the expected value. Volatility is reflected in deviations of actual returns from the mean

return.

σ 2=∑ p ( s ) [ r ( s )−E ( r ) ]

2

(5.12)

s

To get back to original units, we calculate the standard deviations as the square root (√) of variance.

Excess Returns and Risk Premiums

We measure the reward as the difference between the expected HPR on the index stock fund and the risk-free

rate, that is, the rate you would earn in risk-free assets.

The difference: risk premium on common stocks

The difference in any particular period between the actual rate of return on a risky asset and the actual risk-

free rate is called the excess return.

3

, The risk premium is the expected value of the excess return

The standard deviation of the excess return is a measure of its risk

The degree to which investors are willing to commit funds to stocks depends on their risk aversion.

If the risk premium were zero, they would not invest any money in stocks.

General rule: the maturity of the risk-free rate should match the investment horizon.

5.5 Time Series Analysis of Past Rates of Return

Expected Returns and the Arithmetic Average

n n

1

(5.13) E ( r )=∑ p ( s ) r ( s )= ∑ r ( s )

s=1 n s=1

Arithmetic average of historic rates of return

The Geometric (Time-Weighted) Average Return

The arithmetic average provides an unbiased estimate of the expected future return.

An intuitive measure of performance over the sample period is the (fixed) annual HPR that would compound

over the period to the same terminal value obtained from the sequence of actual returns in the time series.

(5.14) ( 1+ g )n=Terminal value=( 1+ r 1 ) × ( 1+r 2 ) … ×(1+ r n)

g=Terminal valu e1 /n

Practitioners call g the time-weighted average return to emphasize that each past return receives an equal

weight in the process of averaging.

If returns come from a normal distribution, the expected difference is exactly half the variance of the

distribution, that is,

1

(5.15) E [ Geometric average ] =E [ Arithmetic average ] = σ 2

2

Variance and Standard Deviation

Because we cannot directly observe expectations, we calculate variance by averaging squared deviations from

our estimate of the expected return, the arithmetic average, ŕ .

Variance=Expected value of squared deviations

σ 2=∑ p ( s ) [ r ( s )−E ( r ) ]

2

Using historical data with n observations, we could estimate variance as

n

1 2

(5.16) σ^ 2= ∑ [ r ( s )−ŕ ]

n s=1

This estimate is biased downward. The reason is that we have taken deviations from the sample arithmetic

average instead of the unknown, true expected value, and so have introduced an estimation error.

A degrees of freedom bias

We can eliminate the bias by multiplying the arithmetic average of squared deviations by the factor n/(n – 1):

n n

(5.17) σ

2

( )

^ = n × 1 ∑ [ r ( s )− ŕ ] = 1 ∑ [ r ( s ) −ŕ ]

n−1 n s=1

2

1−n s=1

2

4

5.1 Determinants of the Level of Interest Rates

The level of interest rates is perhaps the most important macroeconomic factor to consider in one’s investment

analysis. Forecasts of interest rates directly determine expected returns in the fixed-income market.

We have a good understanding of the fundamental factors that determine the level of interest rates:

1. The supply of funds from savers, primarily households.

2. The demand for funds from businesses to be used to finance investments in plant, equipment, and

inventories (real assets or capital formation).

3. The government’s net demand for funds as modified by actions of the Federal Reserve Bank.

4. The expected rate of inflation.

Real and Nominal Rates of Interest

An interest rate is a promised rate of return denominated in some unit of account over some time period.

What the real return is, depends upon what your money can buy today relative to what you could buy when

you deposited the money.

Nominal interest rate: the growth rate of your money

Real interest rate: the growth rate of your purchasing power

1+ r nom

(5.1) 1+r real =

1+i

A common approximation to this relation is:

(5.2) r real ≈ r nom −1

Rearranging (5.1):

r nom −i

(5.3) r real =

1+i

Conventional fixed income investments promise a nominal rate of interest. You can only infer the expected real

rate on these investments by adjusting the nominal rate for your expectation of the rate of inflation.

The Equilibrium Real Rate of Interest

Three basic factors determine the real interest rate:

Supply

Demand

Government actions

The nominal interest rate is the real rate plus the expected rate of inflation.

The supply curve slopes up from left to right because the higher real interest rate, the greater the supply of

household savings.

At higher real interest rates, households will choose to postpone some current consumption.

The demand curve slopes down from left to right because the lower the real interest rate, the more businesses

will want to invest in physical capital.

1

,The government and central bank can shift these supply and demand curves either to the right or to the left

through fiscal and monetary policies.

The Equilibrium Nominal Rate of Interest

Irving Fischer argued that the nominal rate ought to increase one-for-one with expected inflation, E(i):

(5.4) r nom =r real + E(i)

When real interest rates are stable, changes in nominal rates ought to predict changes in inflation

rates.

Taxes and the Real Rate of Interest

Tax liabilities are based on nominal income and the tax rate determined by the investor’s tax bracket.

The real after-tax rate is approximately the after-tax nominal rate minus the inflation rate:

(5.5) r nom ( 1−t )−i=( r real +i )−i=r real ( 1−t )−it

Because you pay taxes on even the portion of interest earnings that is merely compensation for inflation, your

after-tax real returns falls by the tax rate times the inflation rate.

5.2 Comparing Rates of Return for Different Holding Periods

Zero-coupon bonds are sold at a discount form par value and provide their entire return from the difference

between the purchase price and the ultimate repayment of par value.

100

(5.6) r f ( T )= −1

P(T )

We typically express all investment returns as an effective annual rate (EAR), defined as the percentage

increase in funds invested over a 1-year horizon.

In general, we can relate EAR to the total return, r f(T), over a holding period of length T by using:

1 /T

(5.7) 1+ EAR=[ 1+r f ( T ) ]

Annual Percentage Rates

Annualized rates on short-term investments often are reported using simple rather than compound interest.

Annual percentage rates (APRs)

The relationship among the compounding period, the EAR, and the APR is:

n 1/ T

1+ EAR=[ 1+r f ( T ) ] =[ 1+ r f ( T ) ] = [ 1+T × APR ]

1/ T

(5.8)

Equivalently,

(1+ EAR )T −1

APR=

T

Continuous Compounding

As T approaches zero, we effectively approach continuous compounding (CC), and the relation of EAR to the

annual percentage rate, denoted by rcc for the continuously compounded case, is given by the exponential

function

2

,(5.9) 1+ EAR=exp ( r cc )=e r cc

To find rcc from the effective annual rate, we solve (5.9) for r cc as follows:

ln ( 1+ EAR )=r cc

ln() is the natural logarithm function, the inverse of exp().

The total return scales up in direct proportion to the time period, T.

5.3 Bills and Inflation, 1926-2015

We divide the sample period at 1952. After that year, inflation is far less volatile, and, probably as a result, the

nominal interest rate tracks the inflation rate with far greater precision, resulting in a far more stable real

interest rate.

Dramatic reduction in the standard deviation of the real rate.

The lower standard deviation of the real rate in the post-1952 period reflects a similar decline in the standard

deviation of the inflation rate.

Fischer’s relation appears to work far better when inflation is itself more predictable and investors can more

accurately gauge the nominal interest rate they require to provide an acceptable real rate of return.

5.4 Risk and Risk Premiums

Holding-Period Returns

With an investment horizon of 1 year, the realized rate of return on your investment will depend on:

a. The price per share at year’s end; and

b. The cash dividends you will collect over the year.

Holding period return

Ending price of a share−Beginning price +Cash dividend

(5.10) HPR=

Beginning price

The percent return from dividends is called the dividend yield, and so dividend yield plus the rate of capital

gains equals HPR.

Expected Return and Standard Deviation

(5.11) E ( r )= ∑ p ( s ) r ( s )

s

The variance of the rate of return (2) is a measure of volatility. It measures the dispersion of possible

outcomes around the expected value. Volatility is reflected in deviations of actual returns from the mean

return.

σ 2=∑ p ( s ) [ r ( s )−E ( r ) ]

2

(5.12)

s

To get back to original units, we calculate the standard deviations as the square root (√) of variance.

Excess Returns and Risk Premiums

We measure the reward as the difference between the expected HPR on the index stock fund and the risk-free

rate, that is, the rate you would earn in risk-free assets.

The difference: risk premium on common stocks

The difference in any particular period between the actual rate of return on a risky asset and the actual risk-

free rate is called the excess return.

3

, The risk premium is the expected value of the excess return

The standard deviation of the excess return is a measure of its risk

The degree to which investors are willing to commit funds to stocks depends on their risk aversion.

If the risk premium were zero, they would not invest any money in stocks.

General rule: the maturity of the risk-free rate should match the investment horizon.

5.5 Time Series Analysis of Past Rates of Return

Expected Returns and the Arithmetic Average

n n

1

(5.13) E ( r )=∑ p ( s ) r ( s )= ∑ r ( s )

s=1 n s=1

Arithmetic average of historic rates of return

The Geometric (Time-Weighted) Average Return

The arithmetic average provides an unbiased estimate of the expected future return.

An intuitive measure of performance over the sample period is the (fixed) annual HPR that would compound

over the period to the same terminal value obtained from the sequence of actual returns in the time series.

(5.14) ( 1+ g )n=Terminal value=( 1+ r 1 ) × ( 1+r 2 ) … ×(1+ r n)

g=Terminal valu e1 /n

Practitioners call g the time-weighted average return to emphasize that each past return receives an equal

weight in the process of averaging.

If returns come from a normal distribution, the expected difference is exactly half the variance of the

distribution, that is,

1

(5.15) E [ Geometric average ] =E [ Arithmetic average ] = σ 2

2

Variance and Standard Deviation

Because we cannot directly observe expectations, we calculate variance by averaging squared deviations from

our estimate of the expected return, the arithmetic average, ŕ .

Variance=Expected value of squared deviations

σ 2=∑ p ( s ) [ r ( s )−E ( r ) ]

2

Using historical data with n observations, we could estimate variance as

n

1 2

(5.16) σ^ 2= ∑ [ r ( s )−ŕ ]

n s=1

This estimate is biased downward. The reason is that we have taken deviations from the sample arithmetic

average instead of the unknown, true expected value, and so have introduced an estimation error.

A degrees of freedom bias

We can eliminate the bias by multiplying the arithmetic average of squared deviations by the factor n/(n – 1):

n n

(5.17) σ

2

( )

^ = n × 1 ∑ [ r ( s )− ŕ ] = 1 ∑ [ r ( s ) −ŕ ]

n−1 n s=1

2

1−n s=1

2

4