FINANCIAL MANAGEMENT –

BMAN 311

CONTENT OF NOTES:

SU 1 – 9: CH 1,3,4,5 & 9, 7 & 17, 10, 13, 18, 15&16.

APPLICABLE THEORY & CALCULATIONS

GeekyS

CALCULATIONS ARE SHOWN USING A SHARP EL- 738 BUSINESS/

FINANCIAL CALCULATOR BMAN 311 NOTES AVAILABLE ON

STUVIA.CO.ZA

TEXT BOOK: MARX, J., DE SWART, C., BEAUMONT SMITH, M., &

ERASMUS, P. 2013. Financial Management: in Southern Africa. 4th

ed. South Africa: Pearson Education. 464 p.

,F FINANCIAL MANAGEMENT – BMAN 311 STUVIA.CO.ZA

STUDY UNIT 1: CHAPTER 1

INTRODUCTION TO FINANCIAL MANAGEMENT

Financial management emphasizes on wealth

OUTCOMES: maximization rather than profit maximization. For a

Goal of financial management business, it is not necessary that profit should be the

Financial management and other subjects only objective; it may concentrate on various other

Functions of a financial manager aspects like increasing sales, capturing more market

Principles of financial management share etc, which will take care of profitability.

In wealth maximization, major emphasizes is on cash

flows rather than profit. So, to evaluate various

Introduction alternatives for decision making, cash flows are taken

Why do businesses exist? under consideration. For e.g. To measure the worth of

a project, criteria like: “present value of its cash inflow

• Satisfy human needs by providing a product/

– present value of cash outflows” (net present value)

service.

is taken. This approach considers cash flows rather

What is required to start a business?

than profits into consideration and also use

• Financing – Owners’ Equity / Loans discounting technique to find out worth of a project.

Business forms Thus, maximization of wealth approach believes that

• Sole proprietorship money has time value.

• Partnership A manager should align his/her objective to broad

• Companies objective of organization and achieve a trade-off

between risk and return while making decision;

keeping in mind the ultimate goal of financial

Economic principle management i.e. To maximize the wealth of its

What is the economic principle? current shareholders.

• Statement of inter-relationships among

economic factors that explains what may

cause what, or what may happen under

Basic management tasks

Planning

certain circumstances. Also called economic

Organising

law.

Activating / Leading

Importance in financial management

Control

• Handling of funds & Decision making

Functions of a financial manager

Goal of financial management Investment decisions

Long-term

Financing decisions

• Increase value of the firm

Ensuring Profitability

Short-term

Ensuring Positive cash flow

• Profitability

Ensuring Solvency

• Liquidity

• Solvency

Principles of financial management

Cost-benefit principle

Question The difference between Risk-return principle

Profitability / Wealth

Time-value-of-money principle

2

,F FINANCIAL MANAGEMENT – BMAN 311 STUVIA.CO.ZA

STUDY UNIT 2: CHAPTER 3

UNDERSTANDING FINANCIAL STATEMENTS OF A BUSINESS

The Classification of financial

OUTCOMES:

information

Users of financial statements Assets

Classification of financial information Liabilities

Income Statement Owners' Equity

Balance Sheet Revenues

Cash flow Statement Expenses

Users of financial statements: Financial statements:

Owners/Shareholders Income statement

Management Balance Sheet

Creditors Cash flow statement

labour unions

Investment analysts

The State Accounting Equation: [BEL]

Credit bureaus Assets = Owners' Equity + liabilities

INCOME STATEMENT

Nature Accounting period

• Provides a financial summary of • Refers to the period of time covered by an

performance during a period of time by income statement; month, quarter of a

comparing revenue and expenses. year, half a year or yearly.

Purpose AKA earnings statement, statement of

• To evaluate the profitability of a firm, operations, and profit/ loss statement.

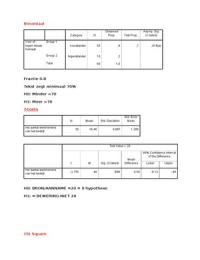

Example of an Income Statement (condensed)

3

, F FINANCIAL MANAGEMENT – BMAN 311 STUVIA.CO.ZA

Example

Complete the Income Statement

Sales 800 000 Interest expense 25 000

Gross profit 450 000 Income tax 50 000

Operating profit 140 000

Income statement Income statement

Sales (Net) 800 000 Sales (Net) 800 000

Less: Cost of goods sold Less: Cost of goods sold 350 000

Gross profit 450 000 Gross profit 450 000

Less: Operating expenses Less: Operating expenses 310 000

Operating Profit 140 000 Operating Profit 140 000

Interest Income - Interest Income -

Earnings before Interest and Tax (EBIT) Earnings before Interest and Tax (EBIT) 140 000

Less: Interest Expenses 25 000 Less: Interest Expenses 25 000

Earnings before tax (EBT) Earnings before tax (EBT) 115 000

Less: Tax 50 000 Less: Tax 50 000

EARNINGS AFTER TAX (EAT) EARNINGS AFTER TAX (EAT) 65 000

BALANCE SHEET

Purpose of balance sheet

• To show the financial position of a business at a particular date

Three elements of a balance sheet

• Assets – Fixed and Current assets

• Owners’ equity (Shareholders equity) – Resources invested by owners

• Liabilities – Long term liabilities and current liabilities

AKA Statement of financial position

Example of old fashioned Balance sheet:

4

,F FINANCIAL MANAGEMENT – BMAN 311 STUVIA.CO.ZA

Example of a modern format - Balance Sheet:

EMPLOYMENT OF CAPITAL

Non-current assets

Fixed assets :- Buildings, Land, Vehicles, Equipment 16 980 400

Current assets 7 090 100

Inventories 1 600 000

Accounts receivable 4 800 020

Cash 690 080

Employment of capital (Total Assets) 24 070 500

CAPITAL EMPLOYED

Shareholders’ Equity 20 870 500

Ordinary share capital 12 000 000

Retained income 7 870 500

Preference share capital 1 000 000

Non-current liabilities 2 400 000

Mortgage bond 2 400 000

Current liabilities 800 000

Capital employed 24 070 500

CASH FLOW STATEMENT

Cash Flow Cash inflow Cash outflow

Movement of cash in and out of Increase cash in business Decrease cash in business

business

Cash Flow Statement

Cash flow from operating activities

Cash flow from investing activities

Cash flow from financing activities

Operating activities Investing activities Financing activities

Income statement Assets Equity, Liabilities

• Cash receipts from sales • Cash inflow from the sale • Cash inflow from: issuing

• Cash paid to suppliers and of property, plant and shares, mortgages and

employees equipment long term and short term

• Collection of loans made to loans

other • Cash outflow from:

• Cash outflow when cash payment of loans/ equity

paid to purchase property, holders

plant or equipment

5

, FINANCIAL MANAGEMENT – BMAN 311 STUVIA.CO.ZA

F

Example of Cash Flow Statement

CASH FLOW STATEMNT FOR THE YEAR ENDED 20**

Cash flows from operating activities 226 480

Cash receipts from customers 9 199 980

Cash paid to suppliers and employees (7 403 000

Cash generated from operations *1 1 796 980

Interest received -

Interest paid *3 (26 000

Dividends Received -

Dividends paid *4 (532 000

Taxation Paid *5 (1 012 500

Cash flows from investing activities (836 820

Purchase of non-current assets (860 820

Proceeds from non-current assets 24 000

Cash flows from financing activities 1 200 000

Proceeds from the issue of share capital 1 000 000

Proceeds from long-term borrowings 200 000

Net change in cash and cash equivalents *2 589 660

Cash and cash equivalents: beginning of year 100 420

Cash and cash equivalents: end of year *2 690 080

PAYMENTS OF DIVIDENDS AND INTEREST ARE NOT REGARDED AS FINANCING ACTIVITIES

Exercises:

Accounts payable Inventories Expenses OUTFLOWS

2010 - R 250 000 2010 R 220 000 Interest expense

2011 - R 230 000 2011 R 200 000 Tax

Influence on cash Outflow Influence on cash Inflow Operating expenses

of R 20 000 (Accounts payable of R 20 000 (Inventories

decrease) decrease)

Accounts receivable Fixed assets Income INFLOWS

2010 R 200 000 2010 R 9 800 000 Interest income

2011 R 190 000 2011 R 9 950 000

Influence on cash Inflow of Influence on cash Outflow

R 10 000 (Accounts receivable of R 150 000 (Fix assets

decrease) increase)

6

,F FINANCIAL MANAGEMENT – BMAN 311 STUVIA.CO.ZA

OPDRAG 1 / ASSIGNMENT 1

Voltooi die Inkomstestaat / Complete the Income Statement

Verkope / Sales 1000 000

Bruto wins / Gross profit 300 000

Bedryfsuitgawes / Operating expenses 150 000

Langtermynlening @10% per jaar / Long-term debt @ 10% per annum 400 000

Belastingkoers / Tax rate 40%

OPDRAG 2 / ASSIGNMENT 2

Voltooi die balansstaat / Complete the balance sheet

Gewone aandelekapitaal / Ordinary share capital 12 000 000

Behoue inkomste / Retained income 8 870 500

Verbandlening / Mortgage bond 2 400 000

Rekeninge betaalbaar / Accounts payable 800 000

Grond en geboue / Land and buildings 8 490 200

Masjinerie en aanleg / Machinery and plant 7 252 200

Voertuie / Vehicles 1 538 000

Opgehoopte depresiasie / Accumulated depreciation 300 000

Kontant / Cash 690 080

Rekeninge ontvangbaar / Accounts receivable 4 800 020

Voorrade / Inventory 1 600 000

7

, F FINANCIAL MANAGEMENT – BMAN 311 STUVIA.CO.ZA

OPDRAG 3 / ASSIGNMENT 3

Voltooi die Inkomstestaat / Complete the Income Statement

Koste van verkope / Cost of sales 500 000

Bruto wins / Gross profit 800 000

Bedryfsuitgawes / Operating expenses 140 000

Langtermynlening @12% per jaar / Long-term debt @ 12% per annum 600 000

Belastingkoers / Tax rate 40%

OPDRAG 4 / ASSIGNMENT 4

Voltooi die balansstaat / Complete the balance sheet

Gewone aandelekapitaal / Ordinary share capital 2 500 000

Behoue inkomste / Retained income 700 000

Verbandlening / Mortgage bond 700 000

Rekeninge betaalbaar / Accounts payable 400 000

Totale kapitaal aangewend / Total capital employed 4 300 000

Grond en geboue / Land and buildings 700 000

Masjinerie en aanleg / Machinery and plant 1 400 000

Voertuie / Vehicles 600 000

Opgehoopte depresiasie / Accumulated depreciation 200 000

Kontant / Cash 300 000

Rekeninge ontvangbaar / Accounts receivable 900 000

Voorrade / Inventory 600 000

8