Ukznaccounting

On this page, you find all documents, package deals, and flashcards offered by seller UKZNAccounting.

- 16

- 0

- 2

Community

- Followers

- Following

1 Reviews received

18 items

Tax 3B: Fringe benefits

Summary of the key details regarding the types of fringe benefits and how to value them, with reference to the 7th schedule of the income tax act, in simple language.

- Package deal

- Summary

- • 14 pages •

Summary of the key details regarding the types of fringe benefits and how to value them, with reference to the 7th schedule of the income tax act, in simple language.

Tax 3B: allowances and reimbursements

Summary of the treatment and calculation of allowances and deductions as set out in S8 of the income tax act.

- Package deal

- Summary

- • 7 pages •

Summary of the treatment and calculation of allowances and deductions as set out in S8 of the income tax act.

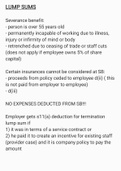

Tax 3B: Lump sums

Summary of how to treat retirement lump sums, retirement lump sum withdrawal benefits and several benefits in the tax framework, as well as their reductions. Set out in an understandable manner.

- Package deal

- Summary

- • 6 pages •

Summary of how to treat retirement lump sums, retirement lump sum withdrawal benefits and several benefits in the tax framework, as well as their reductions. Set out in an understandable manner.

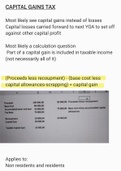

Tax 3A: Capital gains tax

An in-depth summary of how to determine and calculate taxable capital gains for a natural person and company, according to the CGT model with reference to the 8th schedule of the income tax act.

- Package deal

- Summary

- • 10 pages •

An in-depth summary of how to determine and calculate taxable capital gains for a natural person and company, according to the CGT model with reference to the 8th schedule of the income tax act.

Tax 3A: Special deductions

Summary of the key special deductions in the determination of taxable income, with reference to S23 of the income tax act among other sections. This document also summarises what constitutes an assessed loss and how to treat them in different situations.

- Package deal

- Summary

- • 23 pages •

Summary of the key special deductions in the determination of taxable income, with reference to S23 of the income tax act among other sections. This document also summarises what constitutes an assessed loss and how to treat them in different situations.

Tax 3A: General deductions

Summary of the key principles regarding general deductions, with reference to S11(a) and S23(g) of the income tax act as well as case law principles.

- Package deal

- Summary

- • 8 pages •

Summary of the key principles regarding general deductions, with reference to S11(a) and S23(g) of the income tax act as well as case law principles.

Tax 3A: Gross income exemptions

Summary of the key gross income exemptions as per the income tax act, set out in an understandable manner.

- Package deal

- Summary

- • 6 pages •

Summary of the key gross income exemptions as per the income tax act, set out in an understandable manner.

Tax 3A: Gross income special inclusions

Summary of the key gross income special inclusions as per S1 of the income tax act, that are examinable in third year tax, set out in an easy-to-understand manner.

- Package deal

- Summary

- • 6 pages •

Summary of the key gross income special inclusions as per S1 of the income tax act, that are examinable in third year tax, set out in an easy-to-understand manner.

Tax 3A: Gross income definition