Taxation (ACCT341)

University of KwaZulu-Natal (UKZN)

All 20 results

Sort by

Assessed losses & other allowances Summaries for principles of S24, S20 & S20A

-

Ultimate tax 3B summary

- Package deal • 9 items • 2022

-

- R162,00

- 2x sold

- + learn more

The ultimate in-depth summary of Tax 3B topics, prepared by a tax distinction student. Information is colour coordinated, in simple language, and daunting topics are formatted in a systematic way that is easy to understand. Contains all the main points to succeed in any test or exam in tax 3B so is also an incredible study aid.

-

Ultimate tax 3A summary

- Package deal • 7 items • 2022

-

- R162,00

- 2x sold

- + learn more

The ultimate in-depth summary of Tax 3A topics, prepared by a tax distinction student. Information is colour coordinated, in simple language, and daunting topics are formatted in a systematic way that is easy to understand. Contains all the main points to succeed in any test or exam in tax 3A so is also an incredible study aid.

-

Tax 3A: Natural persons

- Summary • 7 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

In depth summary of the tax framework for natural persons. Information is colour coordinated and displayed in the form expected in the exam (the tax framework) with information under each line item for easy understanding. Covers information regarding the calculation of rebates and S11F deductions among others.

-

Tax 3A: Gross income definition

- Summary • 15 pages • 2022

- Available in package deal

-

- R50,00

- 1x sold

- + learn more

High-level summary on the breakdown of the gross income definition that covers the first 4 weeks of lectures, with reference to income tax act and case law principles regarding what constitutes an amount, cash or otherwise, received, accrued, a resident, the source of income, and amounts of a capital nature. Notes are colour coordinated and easy to understand.

-

Tax 3B: Tax avoidance and tax administration act

- Summary • 22 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

In depth summary on tax avoidance as per the income tax act, as well as guidance relating to answer layout in theory questions. The examinable provisions of the tax administration act are summarised in a way so as to include the important ideas.

-

Tax 3B: Estate duties and estate planning

- Summary • 17 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

In depth summary on the estate duty framework and introduction to estate planning. Notes are colour coordinated and valuation sections are grouped with the corresponding property type and described in simple terms, so as to make sense of this relatively daunting topic.

-

Tax 3B: Donations tax

- Summary • 13 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

In depth summary of the man provisions in the income tax act regarding donations tax, including exemptions and valuations of limited interests such as usufructs, fiduciary interests and bare dominiums, set out in a step-by-step manner.

-

Tax 3B: VAT Act

- Summary • 27 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

An in-depth summary of the examinable provisions of the VAT Act and relevant case laws, set out in simple language and a well-structured manner.

-

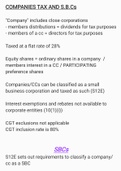

Tax 3B; Companies tax, SBCs and dividends tax

- Summary • 11 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

In-depth summary on the recognition of Small business corporations (SBCs) and general theory on taxation of companies, as well as the examinable theory on dividends tax.

Did you know that on average a seller on Stuvia earns R4500 per month selling summaries? Hmm, hint, hint. Discover all about earning on Stuvia