Taxation (ACCT341)

University of KwaZulu-Natal (UKZN)

Page 2 out of 20 results

Sort by

-

Tax 3B: Employees tax and provisional tax

- Summary • 5 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Well-structured summary on how to calculate employees tax and provisional tax, set out in the manner expected of us in assessments (displayed in the form of the relevant tax framework with notes for each line item for a clear picture.

-

Tax 3B: Fringe benefits

- Summary • 14 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Summary of the key details regarding the types of fringe benefits and how to value them, with reference to the 7th schedule of the income tax act, in simple language.

-

Tax 3B: allowances and reimbursements

- Summary • 7 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Summary of the treatment and calculation of allowances and deductions as set out in S8 of the income tax act.

-

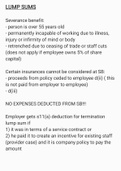

Tax 3B: Lump sums

- Summary • 6 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Summary of how to treat retirement lump sums, retirement lump sum withdrawal benefits and several benefits in the tax framework, as well as their reductions. Set out in an understandable manner.

-

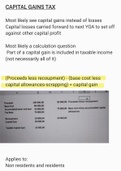

Tax 3A: Capital gains tax

- Summary • 10 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

An in-depth summary of how to determine and calculate taxable capital gains for a natural person and company, according to the CGT model with reference to the 8th schedule of the income tax act.

-

Tax 3A: Special deductions

- Summary • 23 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Summary of the key special deductions in the determination of taxable income, with reference to S23 of the income tax act among other sections. This document also summarises what constitutes an assessed loss and how to treat them in different situations.

-

Tax 3A: General deductions

- Summary • 8 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Summary of the key principles regarding general deductions, with reference to S11(a) and S23(g) of the income tax act as well as case law principles.

-

Tax 3A: Gross income exemptions

- Summary • 6 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Summary of the key gross income exemptions as per the income tax act, set out in an understandable manner.

-

Tax 3A: Gross income special inclusions

- Summary • 6 pages • 2022

- Available in package deal

-

- R50,00

- + learn more

Summary of the key gross income special inclusions as per S1 of the income tax act, that are examinable in third year tax, set out in an easy-to-understand manner.

-

Ultimate Taxation 3A Summary

- Summary • 27 pages • 2021

-

- R50,00

- 3x sold

- + learn more

This is a simple and effective notes to help you understand the concepts and principles taught in the 3rd year of Taxation. The summary is guaranteed to give you a good indication of what usually comes out in the tests and exams. There is an in-depth analysis of each topic studied in the 1st semester of Taxation 3rd year. It contains the following topics: - Special inclusions - Exemptions - General deductions - Special deductions - Assessed losses - Capital allowances - Capital Gain...

Do you wonder why so many students wear nice clothes, have money to spare and enjoy tons of free time? Well, they sell on Stuvia! Imagine your study notes being downloaded a dozen times for R250 each. Every. Single. Day. Discover all about earning on Stuvia